TOP 3 REASONS TO BUY Resident Evil Village Trauma Pack FOR PC1- An exclusive content pack for Resident Evil Village. 2- Enjoy the new Samurai Edge weapon and different accessories. 3- New Resident Evil 7 features and effects plus an additional difficulty level.

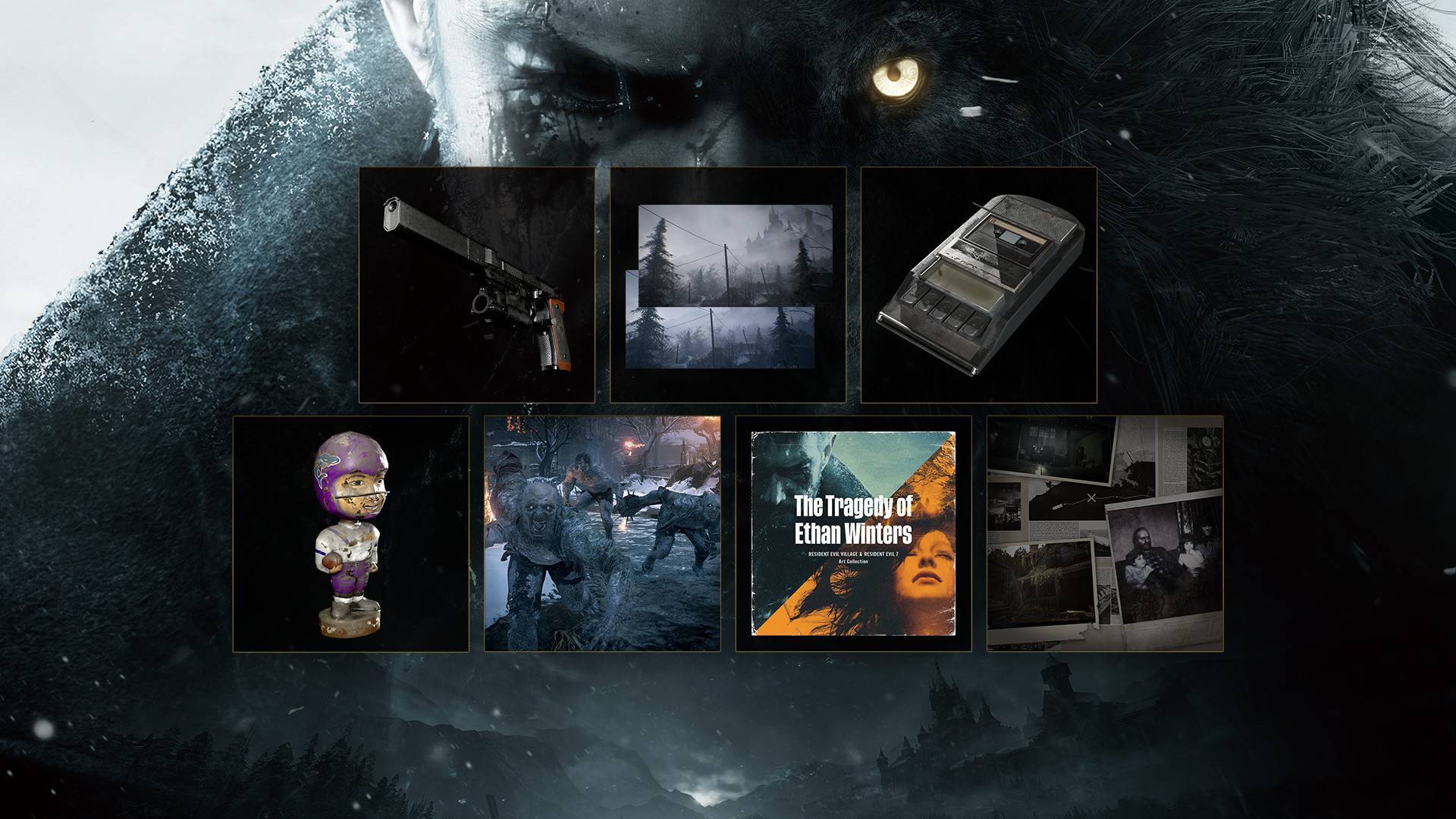

Resident Evil Village Trauma Pack PC INFORMATIONCONTENT OF THE TRAUMA PACKThis is a post-launch DLC that allows you to unlock the following additional content: + New Samurai Edge AW Model01 weapon. + RE7 VHS screen filter + RE7 Video Recorders + New theme song "Go Tell Aunt Rhody". + Mr.

Everywhere weapon accessories + New difficulty level + Ethan Winters concept art + Baker Family ReportRemember that to enjoy all the content of the Trauma Pack, you need the Resident Evil Village videogame which is sold separately from this DLC. ABOUT RESIDENT EVIL VILLAGEThe new and terrifying episode of the prestigious saga of action and horror games that will transport you a few years after the events of Resident Evil 7. Ethan Winters will fight to escape alive with his wife Mia from a terrible cursed village where they have been trapped after a series of terrible events.

Simply enter your email in the "Price Alert" button and we will notify you as soon as the price drops. If what you need is more information about all the news of this game, then we recommend you to visit the official website of the developer CAPCOM.

November 23, 2020

Cyberpunk 2077 retail copies already out there, leaks are coming…. Read more

November 19, 2020

iO Interactive unveils its new project called Project 007. Watch video

November 19, 2020

Among Us is getting a new map. Read more

November 19, 2020

Far Cry 6 release date listed as May 26 in Microsoft store. Read more