|

Global Standard -3%: CDKEYZ | |

|

Global Steam Gift -3%: CDKEYZ |

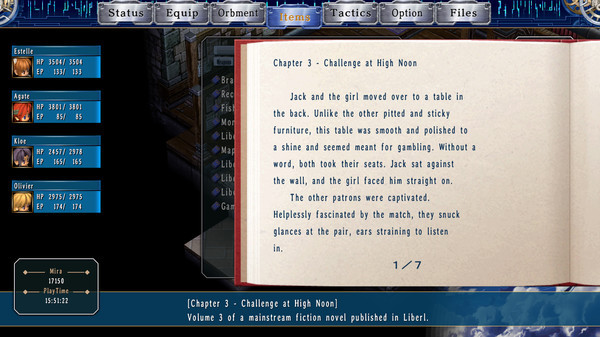

Picking up shortly after The Legend of Heroes: Trails in the Sky, Estelle travels across Liberl in search of Joshua. The journey involves more than seeking loved ones, however, as the Bracer Guild also tasks her with unraveling the mysteries behind the newly unveiled Society of Uroboros.

This is a Japanese role playing game that you do not see often anymore. The story is epic, the localisation makes characters into persons and everything combined makes this game a must have for JRPG lovers and gamers that appreciate a good story.

If you've played Trails FC, there's a good chance you're already waist-deep in SC, and so my review isn't going to sway you one way or another. For those who haven't yet taken the plunge, I cannot stress enough that SC is a direct sequel that takes place immediately following the ending of the first game, so I recommend beating FC first.

Trails in the Sky: Second Chapter is a perfect sequel to the first entry. It offers some subtle improvements, while also keeping the focus on what Legends of Heroes does best; that narrative. It's traditional, but classy, and well worth the time it takes to play through it all.

If you're a fan of the series (or just of JRPGs in general), then The Legend Of Heroes: Trails In The Sky SC will offer you an engaging narrative as well as enough complex and challenging battles to tide you over till Christmas.

Perhaps one day gamers outside Japan will be able to appreciate the full scope of this series, which takes time to develop pieces of its world in detail. Until then, at least the two Trails in the Sky games show how rewarding the series can be, and the upcoming Cold Steel shows that more is on the way for non-Japanese speakers.

Trails In The Sky SC is one of the most adored JRPG, thanks to his incredibly deep story. The western conversion comes a little to late to give justice to this masterpiece: the weight of years is felt on the graphics.

I’m not going to say it’s a bad game. I can definitely see glimmers of an awesome game here and there, and can totally understand why so many people consider it a masterpiece. But, it just wasn’t for me.

November 23, 2020

Cyberpunk 2077 retail copies already out there, leaks are coming…. Read more

November 19, 2020

iO Interactive unveils its new project called Project 007. Watch video

November 19, 2020

Among Us is getting a new map. Read more

November 19, 2020

Far Cry 6 release date listed as May 26 in Microsoft store. Read more

August 17, 2020

Sony Confirms Work On ‘Next-Generation’ VR Headset That Might Not Be PSVR 2. Read more

August 17, 2020

About 40% of worldwide population plays video games of some form, only 8% on consoles. Read more

August 14, 2020

Ubisoft potentially teasing return of delisted Scott Pilgrim game. Read more

August 13, 2020

Fable job listings suggest game is still a long ways away. Read more