|

Global Standard -3%: CDKEYZ | |

|

Global Standard -3%: CDKEYZ | |

|

Europe Steam Gift | €13.59 |

|

Europe Steam Gift -3%: CDKEYZ |

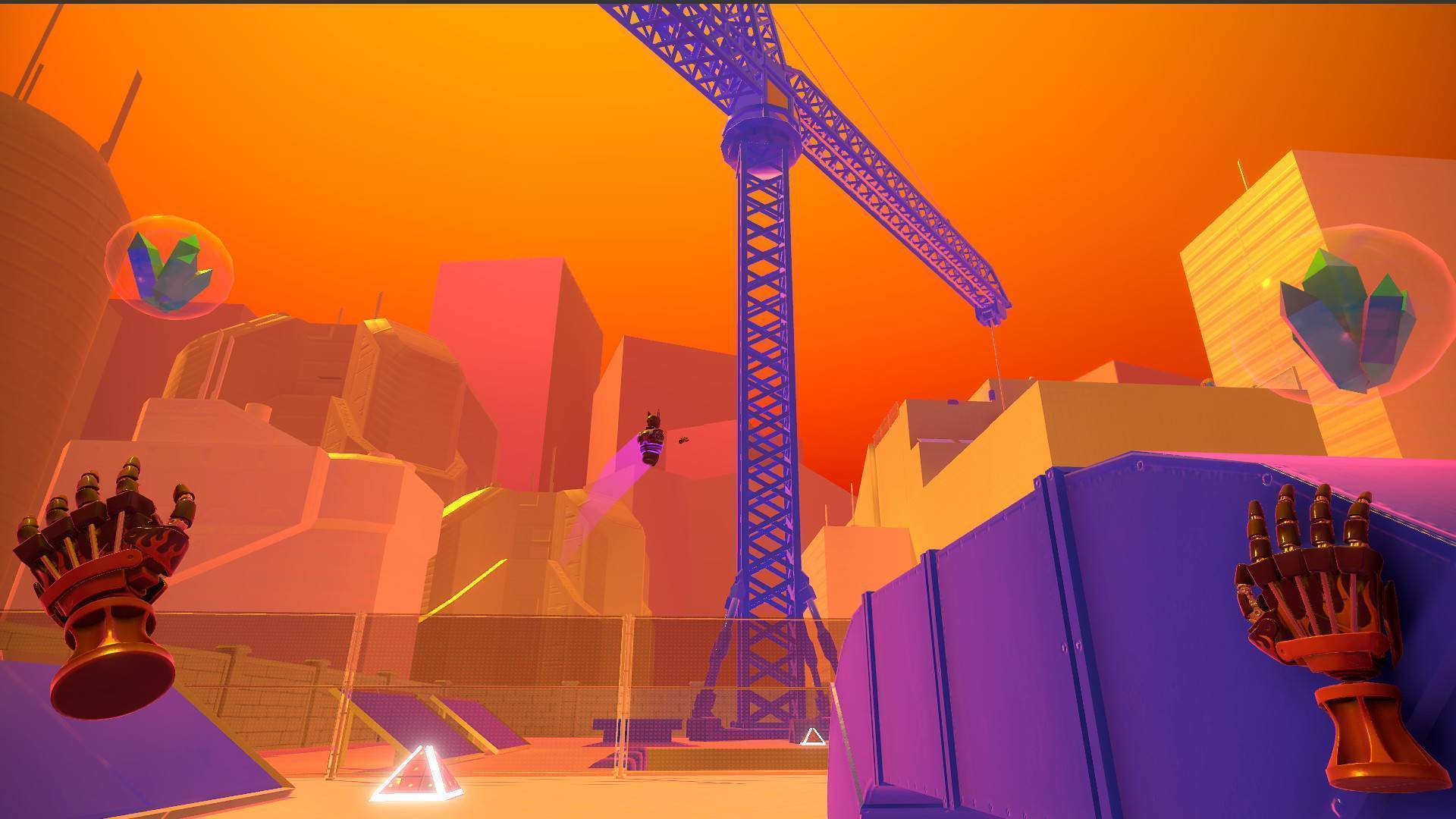

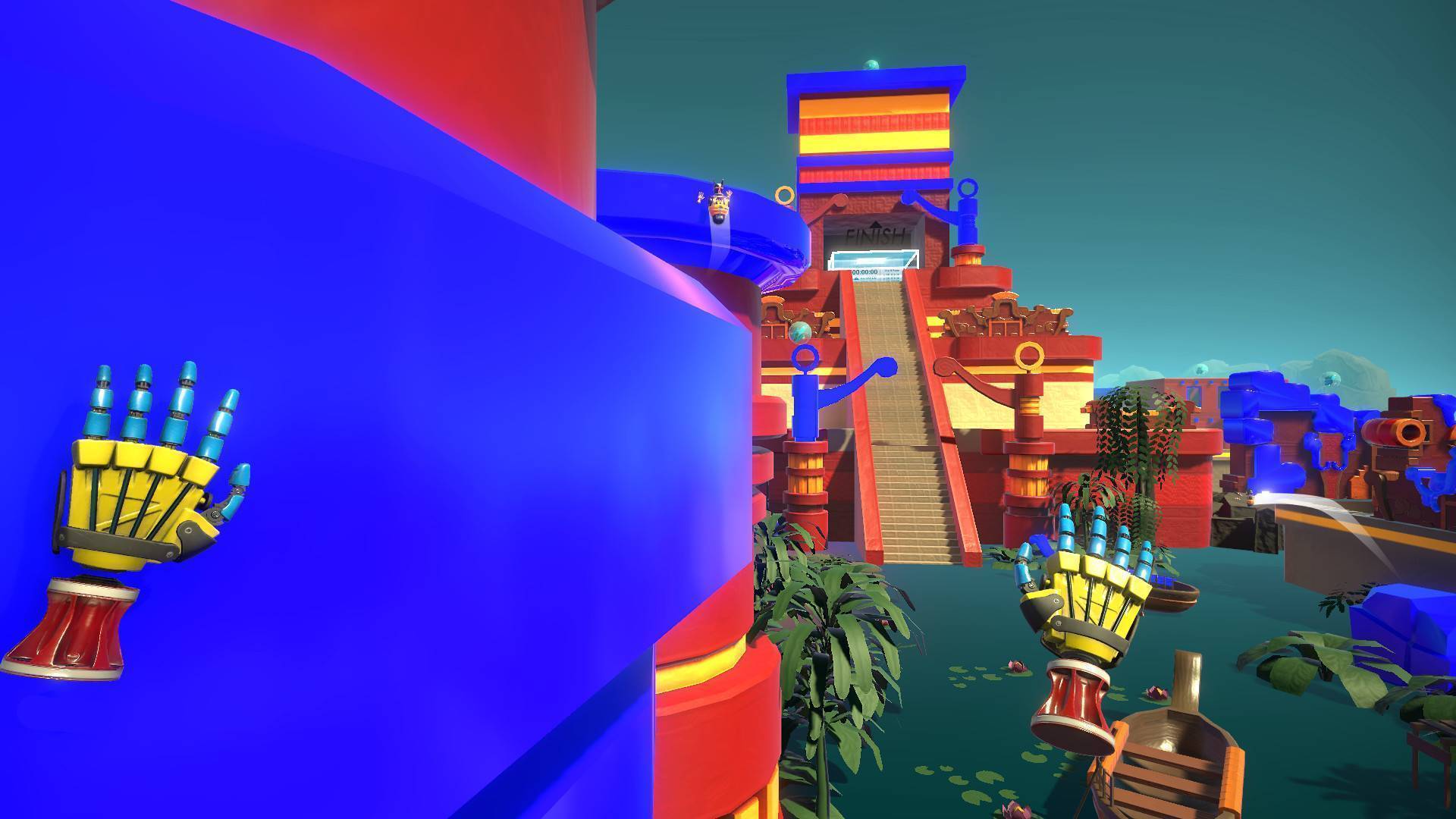

VR Climbing / Platforming Game, that gives you the freedom to move across the environment with superhuman abilities. Conquer over 30 levels with new obstacles and challenges. Compete for the fastest times or explore the environment.

Experience the freedom of movement.

Despite the lack of multiplayer and the horror of ham-fisted progression gates, To The Top is still one of the most singularly fun experiences I’ve ever had inside my VR headset. It’s gameplay is simple, but addictive, and rewards skillful play while never demanding you become an expert all at once. The progression gates are annoying but mostly because they held me back from tearing into more of this truly amazing experience.

While To the Top may be a bit short on polish its sense of movement is fantastic. Once you’ve got the hang of managing your momentum you can practically fly through the levels, springing from point to point like a hypercaffeinated frog. Every level offers something different, whether that be new scenery, air-vortex jump pads, special surfaces that let you skate over them and even one memorable level that gives you jetpack hands. (That particular level made me glad to play at night when nobody was watching so they couldn’t see me with arms pointed back, leaning forward to get just the right angle to skim ahead at top speed.) The multiple routes and hidden challenges make each area highly replayable, and while some levels aren’t quite as good as others, at least they’re different enough so if you don’t like one there’s a complete change of pace coming right up. To the Top is a fantastically creative first-person VR platformer, filled with great challenges and giving the player the tools to handle them if only they can master the techniques.

One of the oddest VR experiences on the market that blends platforming with bouncy castle aesthetics.

February 21, 2020

Free FIFA 20 update brings South America’s top tournament to the game.

September 4, 2019

Gamestop leaks that a new Splinter Cell is coming. Read more

February 15, 2019

Konami will stop selling PES 2019 myClub Coins in Belgium. Read more

January 30, 2019

EA will stop selling FIFA Points in Belgium to comply with the local gambling law. Read more

January 29, 2019

Nintendo Wii will stop its store activity this week. Read more

December 20, 2018

Islands of Nyne: Define Human stops the development of its battle royale. Read more

December 5, 2018

Epic Games stops the active development of Unreal Tournament. Read more

November 15, 2018

Beholder 2: the dystopian game will be released on December 5 on Steam. Read more